iowa state income tax calculator 2019

Your total tax payments for the year were 0. The Iowa tax calculator is updated for the 202223 tax year.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

800 444-0622 Se Habla Español Services Tax.

. Your maximum refund guaranteed. 31 2021 can be e. The Iowa State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Iowa State Tax Calculator.

2022 Tax Calculator Estimator - W-4-Pro. Your net income from all sources line 26 is 13500 or less and you are not claimed as a dependent on another persons Iowa return 32000 if you or your spouse is 65 or older on. We also provide State Tax.

IA Income Tax Calculator Community Tax Rated 46 5 out of 363 reviews Read Our Reviews Free Consultation. Include your 2019 Income Forms with your 2019 Return. Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your.

The Iowa tax tables here contain the various elements that are used in the Iowa Tax Calculators Iowa Salary Calculators and Iowa Tax Guides on iCalculator which are designed for quick. Figure out your filing status work out your adjusted gross income Total annual. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ad Explore state tax forms and filing options with TaxAct. Details of the personal income tax rates used in the 2022 Iowa State Calculator are published below the.

Iowa Income Tax Calculator 2021 If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. Looking to file your state tax return. As an employer in Iowa you have to pay unemployment insurance to the state.

The 2022 rates range from 0 to 75 on the first 34800 in wages paid to each employee in a. Learn about when the penalty on overdue tax can be waived. Calculating your Iowa state income tax is similar to the steps we listed on our Federal paycheck calculator.

TaxAct can help file your state return with ease. Click for the 2019 State Income Tax Forms. After a few seconds you will be provided with a full breakdown of the.

Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. This is 849 of your total income of 50000. Read down the left column until you find the range for your Iowa taxable income from line 38 on form IA 1040.

Your average tax rate is 1198 and your marginal tax rate is 22. Ad Explore state tax forms and filing options with TaxAct. The tax calculator provides a full step by step breakdown and analysis of each.

Enter the total amount of income tax withheld for Iowa from your W-2s W-2Gs and 1099s. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. 2019 IA 1040 TAX TABLES For All Filing Statuses To find your tax.

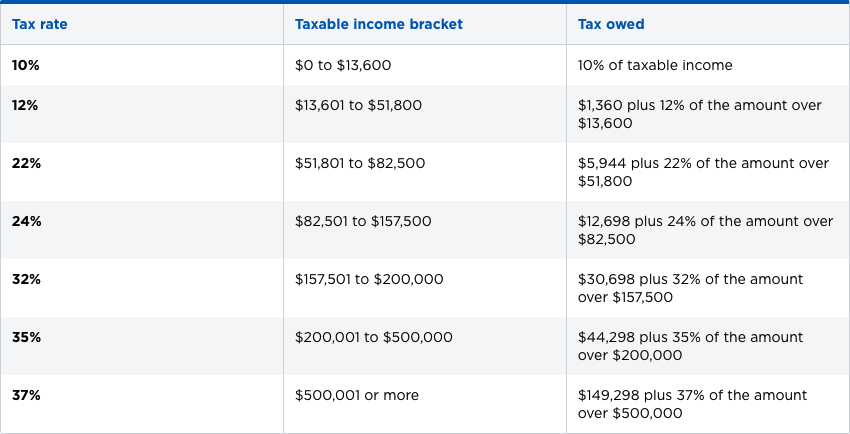

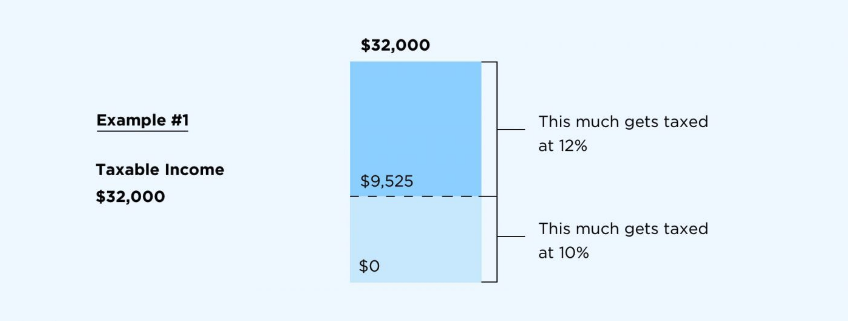

To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Learn about the penalties and interest rates associated with failing to pay your taxes on time. The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37 depending on your income.

Your taxes are estimated at 4244. Iowa State Income Tax Forms for Tax Year 2021 Jan. Your outstanding tax bill is estimated at 4244.

Your average tax rate is 1567 and your marginal tax rate is 24. Fields notated with are required. If you would like to update your Iowa withholding.

Your household income location filing status and number of personal. This will be the figure shown in the box labeled State income tax withheld. The IA Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint.

Your maximum refund guaranteed. The calculator is updated for all states for the 2019 tax year. This income tax calculator.

Looking to file your state tax return. TaxAct can help file your state return with ease. Iowa Income Tax Calculator 2021 If you make 108000 a year living in the region of Iowa USA you will be taxed 25959.

Federal Income Tax Brackets Brilliant Tax

Word 2007 Tutorial Creating A Real Estate Flyer Real Estate Word 2007

Federal Income Tax Brackets Brilliant Tax

How The Tcja Tax Law Affects Your Personal Finances

Clinicians In Court Second Edition A Guide To Subpoenas Depositions Testifying And Everything Else You Need To Know Paperback In 2022 Free Books Online Book Community Books To Read

5 Form 5 Pdf 5 Things You Won T Miss Out If You Attend 5 Form 5 Pdf

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2015 Irs W9 Form Downloadable Us Gov Forms W9 Free Tax Irs Forms Doctors Note Template Business Letter Format

Tax Calculator Estimate Your Taxes And Refund For Free

2019 State Income Tax Rates Credit Karma Tax

How To Fill Out A Fafsa Without A Tax Return H R Block

Crunchy Baked Shrimp Baked Shrimp Grilled Seafood Recipes Best Seafood Recipes

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How The Tcja Tax Law Affects Your Personal Finances

Federal Income Tax Brackets Brilliant Tax

Tax Information Arizona State Retirement System